All about Reverse Charge Mechanism (RCM) under GST

GST / Dec 10, 2024

Introduction to GST and RCM

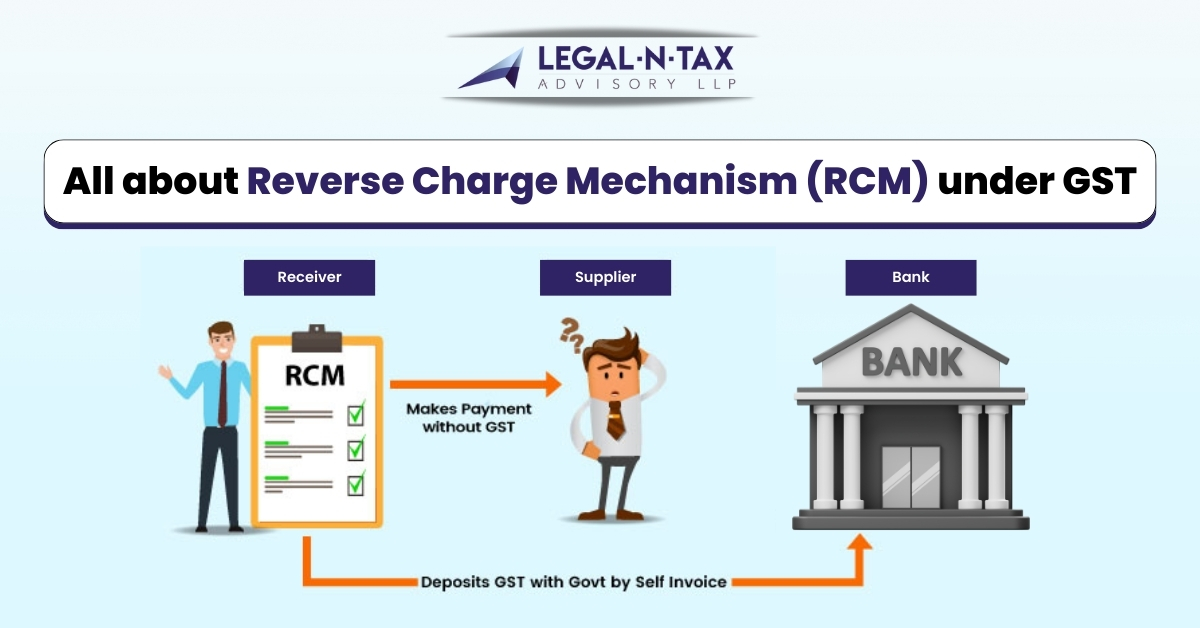

The Goods and Services Tax (GST) has revolutionized India’s indirect tax system by unifying various taxes under one umbrella. While the GST framework is primarily built on the concept of the forward charge mechanism, the Reverse Charge Mechanism (RCM) is a critical exception that businesses need to understand.

RCM shifts the tax liability from the supplier to the recipient, which might sound confusing at first but has its logic and benefits.

Understanding the Reverse Charge Mechanism

How RCM Works

Under RCM, the buyer, instead of the seller, is responsible for paying GST directly to the government. This applies to specific goods and services as notified by the government.

Purpose of RCM

RCM ensures tax compliance in situations where the supplier might not be equipped to pay taxes or where tax evasion risks are high. It also brings unregistered dealers into the tax framework indirectly.

Applicability of RCM under GST

RCM for Specific Goods

Certain goods, such as cashew nuts, bidi wrappers, and lottery tickets, fall under the RCM ambit.

RCM for Specific Services

Services like legal services provided by advocates, services by a director to a company, and GTA (Goods Transport Agency) services are covered under RCM.

RCM for Unregistered Dealers

Transactions with Unregistered Dealers

If a registered dealer purchases goods or services from an unregistered dealer, the tax liability shifts to the registered buyer.

Impact on Registered Buyers

Registered buyers need to pay GST on such transactions, file returns, and claim Input Tax Credit (ITC) where applicable.

Notification and Updates on RCM

Key Notifications

The government periodically issues notifications to update the list of goods and services under RCM.

Recent Changes

The scope of RCM has expanded over the years, with increased emphasis on services from unregistered suppliers.

Tax Compliance Under RCM

Responsibilities of the Recipient

Recipients are responsible for calculating and depositing GST under RCM, filing returns, and maintaining records.

Tax Payment Process

GST under RCM must be paid via cash and not through ITC.

Input Tax Credit and RCM

Can Input Tax Credit be Claimed?

Yes, ITC can be claimed for GST paid under RCM, provided the goods or services are used for business purposes.

Conditions for Availing ITC

The recipient must ensure proper documentation and compliance with GST return filing requirements.

Challenges Faced in RCM Compliance

Common Issues for Businesses

Businesses often struggle with identifying transactions subject to RCM and maintaining accurate records.

Penalties for Non-Compliance

Non-compliance can lead to penalties and interest, adding financial burdens on businesses.

Benefits of RCM for the Economy

Addressing Tax Evasion

RCM reduces tax evasion by making the recipient accountable for tax payments.

Promoting Compliance

It ensures a higher level of compliance within the GST ecosystem.

RCM Scenarios: Case Studies

RCM in Import of Goods

When goods are imported, the importer must pay IGST under RCM.

RCM for Services by Advocates

Legal services provided by advocates are a common example of RCM application.

Exemptions under RCM

Goods and Services Exempted

Basic necessities and small-scale suppliers are exempted from RCM.

Understanding the Threshold

Transactions below the specified threshold value are not subject to RCM.

RCM vs Forward Charge Mechanism

Key Differences

While the forward charge is supplier-driven, RCM shifts responsibility to the recipient.

When to Use Which Mechanism

The choice depends on the nature of goods or services and supplier registration status.

Compliance Tips for Businesses

Best Practices for RCM

- Regularly review notifications.

- Maintain detailed records of RCM transactions.

Tools to Simplify RCM Filing

Use automated GST software for error-free compliance.

Future of RCM under GST

Predictions and Trends

With evolving business needs, RCM is likely to expand its scope further.

Possible Changes

Policymakers might simplify RCM processes to reduce the compliance burden.

Conclusion and Key Takeaways

RCM under GST is a crucial mechanism to ensure tax compliance and accountability. While it might seem complex initially, understanding its nuances can help businesses navigate GST effectively. By staying updated and adopting best practices, companies can ensure seamless compliance and avoid penalties.

FAQs on RCM under GST

-

What is the main purpose of RCM?

RCM ensures tax compliance in situations prone to tax evasion or involving unregistered suppliers. -

Can I claim ITC on GST paid under RCM?

Yes, provided the goods or services are for business purposes and all compliance requirements are met. -

Are all goods and services subject to RCM?

No, only specific goods and services notified by the government are under RCM. -

What happens if I fail to comply with RCM?

Non-compliance can result in penalties and interest. -

How can businesses simplify RCM compliance?

Using automated GST software and staying updated with notifications can help streamline RCM processes.

Share this with others: