INCOME TAX

Taxes / Sep 20, 2021

INCOME TAX

Income tax is levied by central government on the income earned by the individuals and business across India during a financial year. Basically, the main question every citizen wants to know is why these taxes are charged? The answer to this question is Taxes are source of revenue for the government for proper functioning of an economy. Government mainly collects taxes in two ways, direct taxes and indirect taxes. Direct taxes are directly levied on income earned, for example Income tax. Indirect taxes are levied on the price of goods or services, for example Goods and Service Tax (GST) or custom duty. All the taxes collected every year are utilized in developing the infrastructure, providing proper education, good healthcare and hygiene, resources to farmers or agriculture sector, resources to defense and resources for the survival of every sector in the society.

Here, we’re covering Income Tax. How it is applied and collected? What is income tax return (ITR)? How it is filed? Why it is important to file ITR and pay taxes? And everything you should know about income.

In India, this tax was introduced for the first time in 1860, by Sir James Wilson in order to meet the losses sustained by the Government on account of Military Mutiny of 1857. This is one of the main sources of Governments’ revenue to run a country and fulfil the needs of civilians.

Sources of Tax Revenue and Receipts

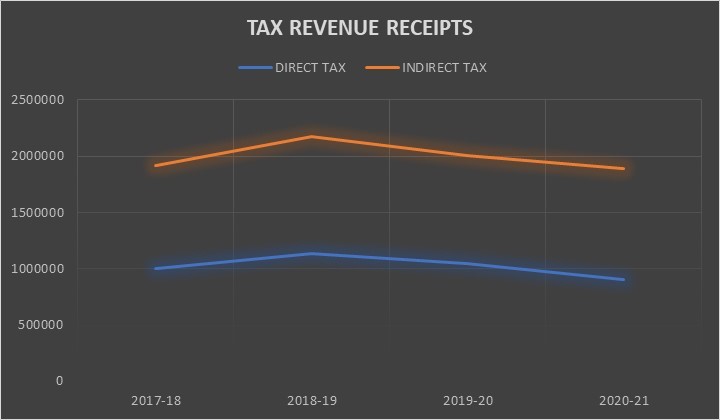

Tax revenue collected by government from different kinds of taxes: direct taxes (personal income tax and corporate tax) and indirect taxes during last four years is declining due to various reasons affecting the economy. One can trace by the graph easily how the tax revenue has been declining over past years. In 2017-18, Direct taxes were 52.34% of total tax revenue whereas rest of 47.66% were indirect tax revenue. Indirect taxes had increased in 2018-19 to 47.85% and rest of 52.15% were direct tax revenue. In 2019-20, direct taxes were recorded at a percentage of 52.40% and indirect taxes percentage of 47.60%. However, in 2020-21 direct taxes contributed 47.77% and indirect taxes contributed 52.23% in total tax revenue.

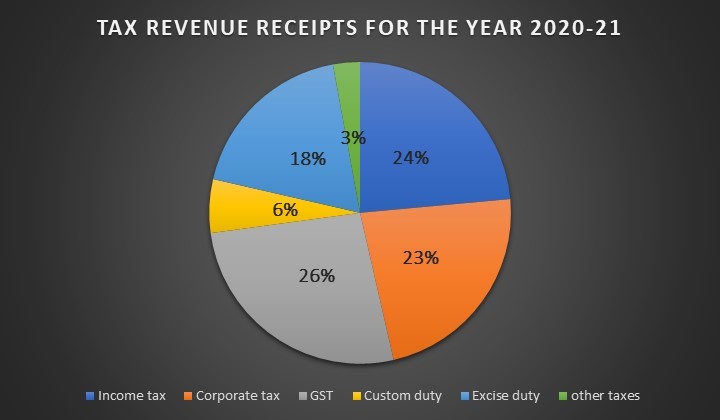

Last year, in AY 2020-21 total tax revenue is bifurcated into various heads. Goods and services tax (GST) contributed the largest share in the total tax revenue of 26%. Followed by income tax of 24%, corporate tax of 23%, excise duty of 18%, custom duty of 6% and other miscellaneous taxes 3%.

Taxpayers in India

Under Income tax act, various types of taxpayers are described in categories so as to apply different tax rates for different types of taxpayers.

Taxpayers are categorized in following way:

Ø Individuals, Hindu Undivided Family (HUF), Association of Person (AOP) and Body of Individuals (BOI)

§ Individuals are broadly classified into Residents and Non-residents. Resident individuals are liable to pay taxes on globally as well as domestically earned income. Whereas, non-residents only liable to pay taxes on income earned or accrued in India. Resident individuals are further bifurcated into three categories:

1. Individuals less than 60 years of age

2. Individuals between age of 60 to 80 years

3. Individuals aged more than 80 years

Ø Firms

Ø Companies

Heads of Income

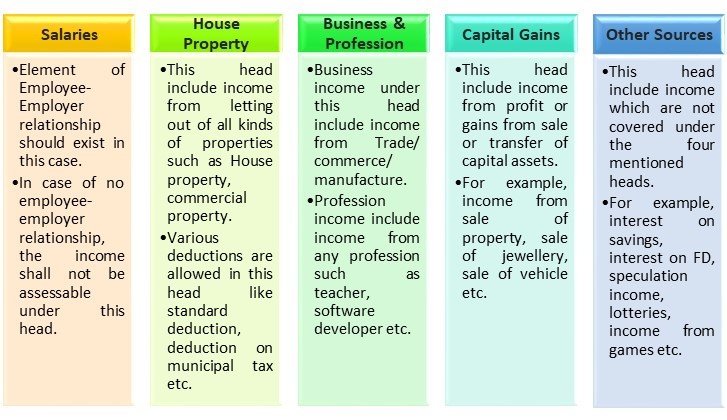

Income Tax Act classifies income under five heads as per section 14, for the purpose of charging tax and computation of total income.

Ø Income from Salaries

Ø Income from House Property

Ø Income from Business and Profession

Ø Income from Capital Gains

Ø Income from Other Sources

Income of any taxpayer is covered within these five classifications. However, there are several incomes which are tax free, for example agriculture income. Also, various deductions are also allowed to taxpayers for computing net income which helps in reduction of tax liability substantially.

Income Tax Return (ITR)

Income Tax Return (ITR) is type of form supposed to be submitted by person to the Income Tax Department of India which contain all the information about the person’s income and the tax liability during Assessment Year. The tax liability of a taxpayer is based on his or her income and the slab rates applicable. In case the ITR shows that excess tax liability has been paid during a year, then the taxpayer will receive Income Tax Refund from the Income Tax Department.

Generally, taxes on the income earned in particular year (financial year) is liable to be paid in the following year known as Assessment year. Financial year in India starts on 1st April and ending on 31st March of the next year.

Income Tax Return (ITR) works as proof of the income earned by taxpayer during a particular year. The Return have to filed before due date specified by the department. If taxpayer fails to abide by the deadline, he or she has to pay a penalty imposed. Income Tax Return filing is compulsory for person whose income is exceeding the basic exemption limits.

Due Date to file ITR for AY 2021-22 is 31st December, 2021

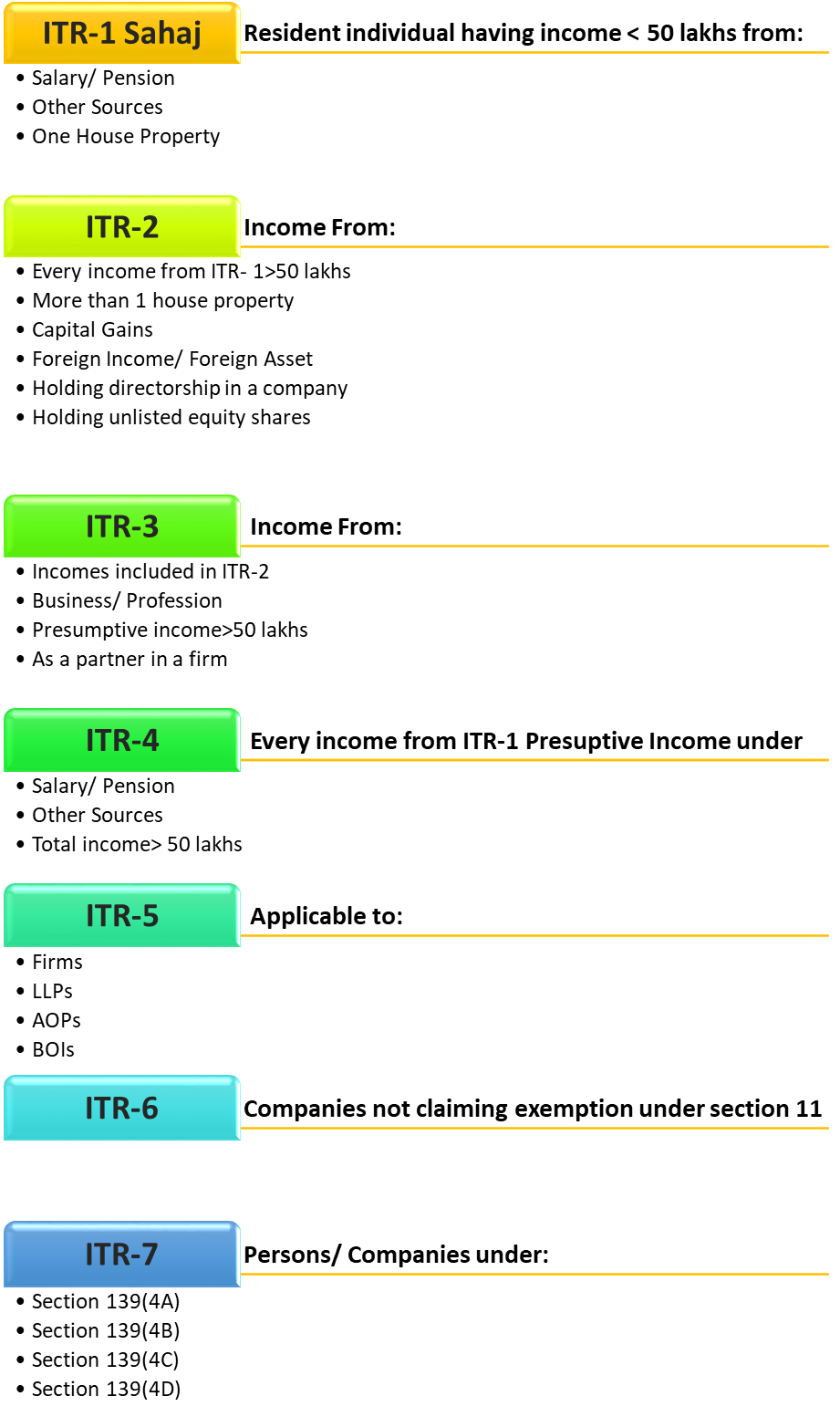

Income Tax Return (ITR) Forms

Slab Rates under Old Tax Regime and New Tax Regime for Person described in Income Tax Act, 1961

1. Income Tax Rate & Slab for Individuals & HUF:

· Individuals (Resident or Resident but not Ordinary Resident or Non- Resident), who is of the age of less than 60 years and for HUF:

|

Taxable Income |

Tax Rate (Existing Scheme) |

Tax Rate (New Scheme) |

|

Up to Rs. 2,50,000 |

Nil |

Nil |

|

Rs. 2,50,001 to Rs. 5,00,000 |

20% |

10% |

|

Rs. 5,00,001 to Rs. 7,50,000 |

20% |

10% |

|

Rs. 7,50,001 to Rs. 10,00,0000 |

30% |

10% |

|

Rs. 10,00,001 to Rs. 12,50,000 |

30% |

20% |

|

Rs. 12,50,001 to Rs. 15,00,000 |

30% |

25% |

|

Above Rs. 15,00,000 |

30% |

30% |

· Individuals (Resident or Resident but not Ordinary Resident or Non- Resident), who is of the age of more than 60 years or less than 80 years:

|

Taxable Income |

Tax Rate (Existing Scheme) |

Tax Rate (New Scheme) |

|

Up to Rs. 2,50,000 |

Nil |

Nil |

|

Rs. 2,50,001 to Rs. 3,00,000 |

Nil |

10% |

|

Rs. 3,00,001 to Rs. 7,50,000 |

20% |

10% |

|

Rs. 7,50,001 to Rs. 10,00,0000 |

30% |

10% |

|

Rs. 10,00,001 to Rs. 12,50,000 |

30% |

20% |

|

Rs. 12,50,001 to Rs. 15,00,000 |

30% |

25% |

|

Above Rs. 15,00,000 |

30% |

30% |

· Individuals (Resident or Resident but not Ordinary Resident or Non- Resident), who is of the age of 80 years or more:

|

Taxable Income |

Tax Rate (Existing Scheme) |

Tax Rate (New Scheme) |

|

Up to Rs. 2,50,000 |

Nil |

Nil |

|

Rs. 2,50,001 to Rs. 5,00,000 |

Nil |

10% |

|

Rs. 5,00,001 to Rs. 7,50,000 |

20% |

10% |

|

Rs. 7,50,001 to Rs. 10,00,0000 |

30% |

10% |

|

Rs. 10,00,001 to Rs. 12,50,000 |

30% |

20% |

|

Rs. 12,50,001 to Rs. 15,00,000 |

30% |

25% |

|

Above Rs. 15,00,000 |

30% |

30% |

Surcharge:

· 10% of Income tax where total income exceeds Rs.50 lakh

· 15% of Income tax where total income exceeds Rs.1 crore

· 25% of Income tax where total income exceeds Rs.2 crore

· 37% of Income tax where total income exceeds Rs.5 crore

Education cess: 4% of income tax plus surcharge

Rebate: Applicable on income of individual and HUF below Rs. 5,00,000. Rebate should be amount of Tax liability or Rs. 12,500 whichever is less.

2. Income Tax Rates for AOP/BOI/Any other Artificial Juridical Person:

|

Taxable Income |

Tax Rate |

|

Up to Rs. 2,50,000 |

Nil |

|

Rs. 2,50,001 to Rs. 5,00,000 |

5% |

|

Rs. 5,00,001 to Rs. 10,00,000 |

20% |

|

Rs. 10,00,000 |

30% |

Surcharge:

· 10% of Income tax where total income exceeds Rs.50 lakh

· 15% of Income tax where total income exceeds Rs.1 crore

· 25% of Income tax where total income exceeds Rs.2 crore

· 37% of Income tax where total income exceeds Rs.5 crore

Education cess: 4% of tax plus surcharge

3. Tax Rate For Partnership Firm:

A partnership firm (including LLP) is taxable at 30%.

Surcharge: 12% of Income tax where total income exceeds Rs. 1 crore

Education cess: 4% of Income tax plus surcharge

4. Income Tax Slab Rate for Local Authority:

A local authority is Income taxable at 30%.

Surcharge: 12% of Income tax where total income exceeds Rs. 1 crore

Education cess: 4% of tax plus surcharge

5. Tax Slab Rate for Domestic Company:

A domestic company is taxable at 30%. However, the tax rate is 25% if turnover or gross receipt of the company does not exceed Rs. 400 crore in the previous year.

|

Particulars |

Tax Rate (%) |

|

If turnover or gross receipt of the company does not exceed Rs. 400 crore in the previous year 2018-19 |

25% |

|

If company opted section 115BA |

25% |

|

If company opted section 115BAA |

22% |

|

If company opted section 115BAB |

15% |

|

Any other domestic company |

30% |

Surcharge:

· 7% of Income tax where total income exceeds Rs.1 crore

· 12% of Income tax where total income exceeds Rs.10 crore

· 10% of income tax where domestic company opted for section 115BAA and 115BAB

Education cess: 4% of Income tax plus surcharge

6. Tax Rates for Foreign Company:

A foreign company is taxable at 40%

Surcharge:

· 2% of Income tax where total income exceeds Rs. 1 crore

· 5% of Income tax where total income exceeds Rs. 10 crore

Education cess: 4% of Income tax plus surcharge

7. Income Tax Slab for Co-operative Society

|

Taxable Income |

Tax Rate (Existing Scheme) |

Tax Rate (New Scheme) |

|

Up to Rs. 10,000 |

10% |

|

|

Rs. 10,001 to Rs. 20,000 |

20% |

22% |

|

Above Rs. 20,000 |

30% |

|

Surcharge:

· 12% of Income tax where total income exceeds Rs. 1 crore

· In case of Concessional scheme, surcharge rate is 10%

Education cess: 4% of Income tax plus surcharge

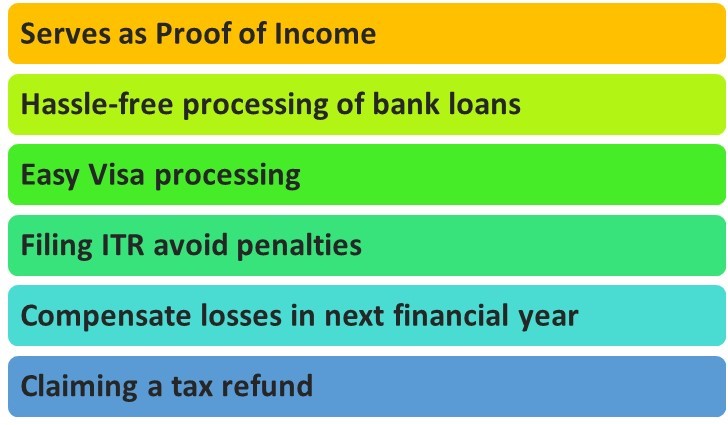

Benefits of filing Income Tax Return

1. Serves as Proof of Income

ITR receipts are very important document to proof the earnings and tax paid by any during a particular year. A person must preserve these receipts for future reference as these contain details of total income from different income heads and tax liability or tax refund.

2. Hassle-free processing of bank loans

Most of the banks and other financial institutions ask for ITR receipts of at least last 3-5 years to process for a high-value loan. These institutes consider ITR the most authentic documents to prove individual’s income.

3. Easy Visa processing

Embassies of developed countries like USA, UK, Canada, Australia etc. ask for ITR receipts of the past years to process your Visa application. They strictly check the compliances followed by individuals during past years including tax compliances. This helps them to ensure that you have sufficient funds to take care of expenses on your trip.

4. Filing ITR avoid penalties

According to section 234F, effective from FY 2017-18, the Income Tax Department levies a penalty of Rs. 10,000 on individuals who do not file their income tax return. You can avoid these penalties by filing ITR returns regularly. Even though the penalty has been kept at Rs 1,000 if your annual income is not more than Rs 5 lakh, as a law-abiding citizen, it is your duty to file your tax returns.

5. Compensate losses in next financial year

As per the income tax law, individuals are not allowed to carry forward losses and set them off against future years’ income if the ITR is not filed within the due date. Hence, it is important to file your income tax return on time in order to claim the losses in future years.

6. Claiming a tax refund

Certain passive income such as term deposit interest or dividend income suffers tax withholding. For many individuals these could be exempt if it is below the threshold. Most of the individual taxpayers having only the above-mentioned income would need to file the tax returns for claiming refund of taxes. Even in the cases of salaried taxpayers where excess taxes are withheld, filing of returns would be mandatory to claim the refund of excess taxes. By filing an ITR online, the refund of taxes can be claimed in the individuals bank account that is KYC-compliant.

Share this with others: